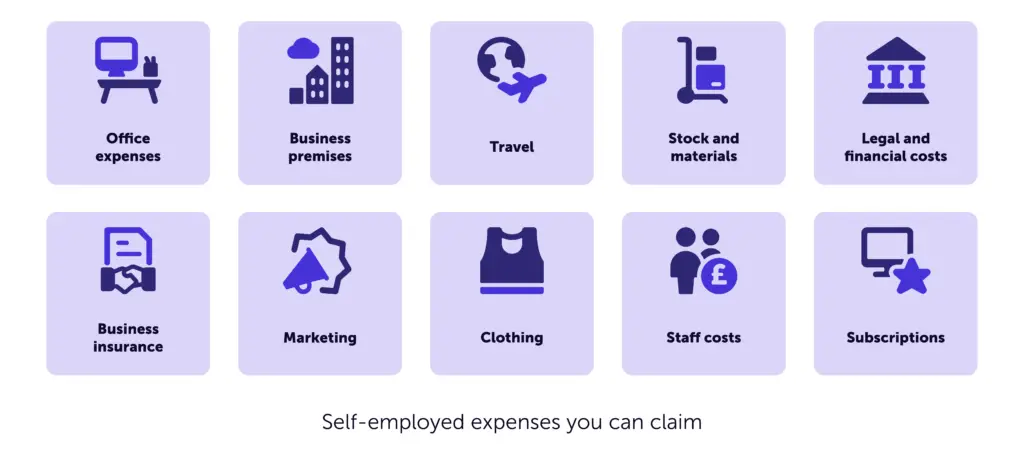

Are you a business owner in the UK? If so, you’ll be glad to know there are a variety of expenses that you can claim to reduce your taxable income. From office supplies to travel expenses, understanding what can be claimed as business expenses is essential for maximizing your profits. In this article, we will explore the different types of expenses that you can claim as a UK business owner, allowing you to make informed financial decisions and potentially save money.

This image is property of pixabay.com.

1. Travel Expenses

1.1. Business Mileage

When it comes to travel expenses, one area that can have a significant impact on your business costs is business mileage. If you use your personal vehicle for business purposes, you can claim for the mileage travelled. The current mileage rate is set by HM Revenue and Customs (HMRC) and is designed to cover the costs of running and maintaining your vehicle, including fuel, insurance, and any necessary repairs or maintenance. It’s important to keep accurate records of your business mileage, including the date, purpose of the journey, and distance traveled, to support your claims.

1.2. Public Transport

If you frequently travel for business using public transport, such as trains, buses, or taxis, you can also claim these expenses as part of your overall travel costs. Keep your receipts and record the purpose of each journey, as well as the dates and costs, to ensure accurate and valid claims. Remember to focus on journeys that are directly related to your business activities, such as meetings with clients or attending conferences or events.

1.3. Accommodation

When you need to stay overnight for business purposes, such as attending conferences or meeting clients in different cities, you can claim the costs of accommodation. This includes hotel stays, bed and breakfasts, or rentals through platforms like Airbnb. Remember to keep all receipts and invoices, including details of the location, dates of the stay, and the purpose of the trip. Your claims should be reasonable and necessary, so it’s essential to choose accommodation options that align with your business requirements.

1.4. Meals

Another travel expense category that you can claim is the cost of meals when you’re away from your usual place of work. These could include breakfast, lunch, dinner, or even snacks throughout the day. HMRC allows for a set daily amount that you can claim for meals, known as subsistence rates. However, it’s important to note that this only applies if you’re away from your usual place of work for a continuous period of at least five hours. Always keep receipts and record the purpose of each meal, along with the date and location.

2. Office Expenses

2.1. Rent or Mortgage

If you have a dedicated space or premises for your business, you can claim for the rent or mortgage interest payments associated with that space. This includes both the actual rental or mortgage interest payments and any related costs, such as building insurance or service charges. It’s essential to keep track of all relevant documentation, including rental or mortgage agreements, invoices, and receipts to support your claims.

2.2. Utility Bills

Running a business requires the use of various utilities, such as electricity, gas, water, and internet. You can claim for the costs associated with these utilities, provided they are solely used for business purposes. Keep copies of your utility bills, along with any relevant receipts or invoices, to substantiate your claims. In the case of internet expenses, it’s a good practice to keep a record of the percentage of internet usage dedicated to business activities, as you may need to apportion the costs accordingly.

2.3. Insurance

Business insurance is essential to protect your company and its assets. The costs of insurance premiums, such as public liability or professional indemnity insurance, can be claimed as business expenses. Ensure you have the necessary documentation, including policy details and receipts, to validate your claims.

2.4. Cleaning and Maintenance

Maintaining a clean and well-maintained work space is important for the smooth functioning of your business. You can claim for expenses related to cleaning services or any necessary maintenance work carried out in your business premises. Keep copies of invoices and receipts to support your claims and ensure they are directly related to your business activities.

2.5. Office Supplies

Office supplies are an integral part of running any business. These include items such as stationery, printer ink, paper, envelopes, and other consumables. The costs of these supplies can be claimed as business expenses. Keep receipts and records of your purchases to support your claims. It’s advisable to separate personal purchases from business-related ones to avoid any confusion or discrepancies.

3. Equipment and Technology

3.1. Computers and Laptops

Investing in essential equipment like computers and laptops is often necessary for running a successful business. If you purchase or lease such equipment specifically for your business, you can claim the costs as expenses. Keep copies of invoices, receipts, or lease agreements to validate your claims.

3.2. Printers and Scanners

Printers and scanners are vital tools in any office environment. Whether you buy or lease this equipment, the costs can be claimed as business expenses. Make sure to keep all relevant documentation, such as invoices and receipts, to support your claims.

3.3. Software

Software plays an increasingly important role in modern business operations. If you purchase or subscribe to software licenses or cloud-based services that are necessary for your business, you can claim these expenses. Keep records of all relevant invoices and receipts to support your claims.

3.4. Mobile Phones and Internet

In today’s connected world, mobile phones and internet services are essential for running a business. If you use a mobile phone or internet service exclusively for business purposes, you can claim the costs as business expenses. Ensure you have the necessary documentation, such as phone bills or internet service provider invoices, to validate your claims.

3.5. Photography and Filming Equipment

If your business requires the use of photography or filming equipment for marketing, advertising, or promotional purposes, the costs of purchasing or leasing this equipment can be claimed as business expenses. Keep copies of invoices, lease agreements, or receipts to support your claims. It’s important to note that the equipment must be solely used for business purposes to be eligible for claiming.

4. Marketing and Advertising

4.1. Website Development and Maintenance

In today’s digital age, a well-designed and regularly maintained website is crucial for any business. The costs associated with website development, including design, domain registration, hosting, and ongoing maintenance, can be claimed as business expenses. Keep records of all invoices and receipts related to your website to support your claims.

4.2. Advertising Campaigns

Marketing and advertising campaigns are essential for promoting your business and attracting customers. If you engage in activities such as online advertising, print ads, or radio spots, the costs incurred can be claimed as business expenses. Keep records of all advertising materials, invoices, and receipts to support your claims.

4.3. Promotional Materials

Promotional materials, such as business cards, brochures, flyers, and branded merchandise, help create brand awareness and attract potential customers. The costs associated with producing these materials can be claimed as business expenses. Ensure you retain all relevant documentation, including invoices and receipts, to support your claims.

4.4. Online Marketing Tools

In the digital marketing realm, various online tools and platforms can help you reach your target audience effectively. If you subscribe to services like email marketing platforms, social media management tools, or search engine optimization software, the costs can be claimed as business expenses. Keep records of your subscriptions, invoices, or receipts to validate your claims.

This image is property of pixabay.com.

5. Professional Services

5.1. Accountant Fees

Hiring an accountant is crucial for managing your business finances effectively. The fees paid to your accountant for services such as bookkeeping, tax preparation, or financial advice can be claimed as business expenses. Keep records of all invoices and receipts related to your accountant fees to support your claims.

5.2. Solicitor Fees

Engaging legal services can be necessary for various business matters, such as drafting contracts or handling legal disputes. The fees paid to solicitors or lawyers for their professional advice or representation can be claimed as business expenses. Ensure you retain all relevant documentation, including invoices and receipts, to support your claims.

5.3. Business Consultancy Fees

If you seek external expertise to help improve your business operations, such as management consultants or business coaches, the fees paid to them can be claimed as business expenses. Keep copies of invoices and receipts related to your consultancy services to substantiate your claims.

5.4. Marketing or PR Agency Fees

If you outsource your marketing or public relations activities to an agency, the fees paid for their services can be claimed as business expenses. Maintain records of all invoices and receipts related to these agency fees to support your claims.

6. Training and Development

6.1. Courses and Workshops

Investing in your professional development is crucial for staying up-to-date with industry trends and improving your skills. The costs associated with attending relevant courses, workshops, or conferences can be claimed as business expenses. Keep records of your course fees, travel expenses, and accommodation costs to support your claims.

6.2. Professional Memberships

Joining professional organizations or industry-specific associations can provide networking opportunities and access to valuable resources. The costs of professional memberships can be claimed as business expenses. Keep records of your membership fees, invoices, or receipts to support your claims.

6.3. Books and Publications

Purchasing books, magazines, or other publications related to your industry can contribute to your professional development. The costs of these educational resources can be claimed as business expenses. Retain copies of your receipts or invoices to validate your claims.

This image is property of pixabay.com.

7. Insurance and Legal Costs

7.1. Liability Insurance

Businesses often require insurance coverage to protect against potential liabilities. The costs of liability insurance premiums, such as public liability or employer’s liability insurance, can be claimed as business expenses. Ensure you have the necessary documentation, including policy details and receipts, to support your claims.

7.2. Professional Indemnity Insurance

Professional indemnity insurance is essential for certain professions, such as consultants or architects, to protect against claims of professional negligence. The costs of professional indemnity insurance premiums can be claimed as business expenses. Keep records of your policy details and receipts to validate your claims.

7.3. Patent and Trademark Costs

If you incur costs related to protecting your intellectual property, such as filing for patents or trademarks, these expenses can be claimed as business expenses. Retain copies of your invoices, receipts, or legal documentation to support your claims.

7.4. Legal Advice and Fees

Engaging legal services for various business matters, such as contract reviews or legal advice, can incur fees. The costs of legal advice and solicitor fees can be claimed as business expenses. Keep records of all relevant invoices and receipts to support your claims.

8. Entertainment Expenses

8.1. Staff Entertainment

Rewarding and motivating your staff through occasional events or activities can contribute to a positive work environment. The costs associated with staff entertainment, such as team-building activities or staff parties, can be claimed as business expenses. Keep records of your staff entertainment expenses, including the names of the staff members involved and the purpose of each event.

8.2. Staff Parties and Events

Hosting staff parties or events can enhance team morale and foster a sense of community within your business. The costs incurred for these occasions, such as venue hire or catering, can be claimed as business expenses. Retain detailed records of your staff party or event expenses, including the purpose of the gathering and the amount spent.

9. Bank and Finance Charges

9.1. Bank Fees

Running a business often involves various banking charges, such as transaction fees or account maintenance fees. The costs associated with these bank fees can be claimed as business expenses. Keep records of bank statements or invoices to substantiate your claims.

9.2. Credit Card Charges

If you use business credit cards for your company’s expenses, the associated credit card charges can be claimed as business expenses. Retain copies of your credit card statements or invoices to support your claims.

9.3. Interest on Loans

If you have taken out business loans or have a business overdraft, the interest paid on these loans can be claimed as business expenses. Ensure you have the necessary documentation, such as loan agreements or bank statements, to support your claims.

10. Miscellaneous Expenses

10.1. Subscriptions and Memberships

Businesses often subscribe to various online platforms or services to enhance their operations. The costs associated with these subscriptions can be claimed as business expenses. Keep records of your subscription fees, invoices, or receipts to support your claims.

10.2. Stationery and Printing

In addition to general office supplies, stationery and printing costs, including ink cartridges, paper, or envelopes, can be claimed as business expenses. Retain copies of your receipts to validate your claims.

10.3. Repairs and Maintenance

If you incur expenses for repairing or maintaining business assets, such as office equipment, vehicles, or premises, these costs can be claimed as business expenses. Keep records of invoices and receipts related to these repair or maintenance services to support your claims.

10.4. Travel and Accommodation Expenses for Employees

If you reimburse your employees for their travel or accommodation expenses incurred for business purposes, these costs can be claimed as business expenses. Retain copies of their receipts and records of the purpose and duration of each trip to validate your claims.

10.5. Staff Training and Development

Investing in the training and development of your staff can lead to improved productivity and business growth. The costs associated with staff training programs or courses can be claimed as business expenses. Keep records of your training expenses, including course fees, travel costs, and accommodation expenses, to support your claims.

In conclusion, there are a wide range of business expenses that can be claimed in the UK, from travel expenses to office supplies, equipment and technology, marketing and advertising, professional services, training and development, insurance and legal costs, entertainment expenses, bank and finance charges, and miscellaneous expenses. By keeping accurate records and retaining necessary documentation, you can maximize your claims and minimize your overall business costs. Always consult with a qualified accountant or tax advisor to ensure compliance with the HMRC guidelines and regulations.