Are you confused about what the PAYE Tax Reference is and how it affects you? Look no further! This article will shed light on this important aspect of your taxes and help you gain a better understanding of how it works. If you are an employer, knowing your PAYE Tax Reference is crucial for maintaining compliance with HM Revenue and Customs PAYE regulation. So, let’s get started and unravel the mystery behind the PAYE Tax Reference together!

Understanding the PAYE Tax Reference

The PAYE Tax Reference is a unique identifier that is assigned to every employer within the Pay As You Earn (PAYE) tax system in the United Kingdom. It is a crucial piece of information that helps in the administration and communication of taxes between employers, employees, and Her Majesty’s Revenue and Customs (HMRC).

What is the PAYE Tax Reference?

The PAYE Tax Reference, also known as the employer reference or tax reference, is a combination of numbers and letters that identifies an employer within the PAYE system. Each employer has a unique reference number, which allows HMRC to track and manage their PAYE tax obligations accurately. It is important to note that individual employees do not have their own PAYE Tax Reference; instead, they are identified through their National Insurance Numbers.

Purpose

The primary purpose of the PAYE Tax Reference is to ensure accurate PAYE tax administration and reporting. It helps HMRC identify employers and track their respective PAYE tax processes. Additionally, the reference number allows employers to communicate with HMRC regarding PAYE tax-related matters, such as submitting periodic PAYE reports, processing end of year returns and summaries.

Format

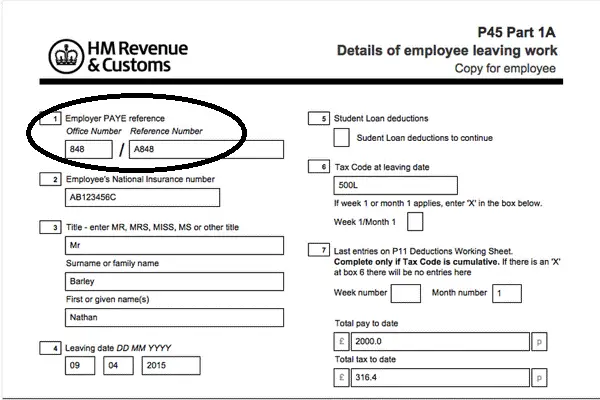

The PAYE Tax Reference consists of a specific format that includes both numbers and letters. The exact structure can vary slightly depending on the employer’s circumstances, but it typically follows a specific pattern. The reference usually contains two parts, separated by a slash, and can be represented as follows: XXX/YYNNNNN.

- The first part, represented by XXX, is a three-digit number that signifies the tax office or HMRC office responsible for the employer’s PAYE tax affairs.

- The second part, represented by YYNNNNN, represents a unique identifier specific to the employer.

For example, a PAYE Tax Reference may look something like 123/AB456789.

How to find your PAYE Tax Reference?

If you are an employee, you do not have your own PAYE Tax Reference. Instead, it is your employer who has the reference number. However, there are several ways you can find your employer’s PAYE Tax Reference if needed.

Employer Communication

Your employer is required to provide you with important tax information, including the PAYE Tax Reference. You can reach out to your employer’s HR department or payroll team and ask for the reference number. They should be able to provide it to you promptly.

Payslips and P60 Forms

Another way to find your employer’s PAYE Tax Reference is by checking your payslips or P60 forms. These documents often contain important tax-related information, including the tax reference number. Look for any references, codes, or numbers mentioned on these documents, as they may provide the necessary information.

HMRC Correspondence

If you still cannot find your employer’s PAYE Tax Reference, you can contact HMRC directly. They may be able to provide you with the reference number or provide guidance on how to obtain it. Ensure that you have relevant information such as your National Insurance Number and employer’s name and address when reaching out to HMRC for assistance.

Why is the PAYE Tax Reference important?

The PAYE Tax Reference holds significant importance for various reasons. Let’s explore some of them below:

Identification

The PAYE Tax Reference serves as a unique identifier for each employer within the PAYE system. It helps differentiate between different employers and ensures accurate tax administration. By using the reference number, HMRC can easily track and manage the tax obligations of each employer.

Tax Administration

The reference number plays a crucial role in the administration of taxes. It allows employers to report their employees’ earnings and deductions accurately, ensuring that the correct amount of tax is deducted from their wages. It also enables HMRC to monitor PAYE tax compliance and resolve any potential discrepancies or issues.

Communication with HMRC

Employers use the PAYE Tax Reference when communicating with HMRC about PAYE tax issues. It serves as a reference point for various tax-related matters, such as submitting payroll reports, requesting tax codes, or resolving any issues with PAYE tax filings. The reference number helps HMRC identify and link specific employers to their PAYE records, making the communication process more efficient and effective.

How is the PAYE Tax Reference used?

The PAYE Tax Reference is used in several ways to facilitate payroll tax administration and compliance. Let’s explore some of its primary uses:

Employer Liabilities

The reference number is used to accurately calculate and manage employer liabilities, such as National Insurance contributions and income tax deductions. It ensures that employers adhere to their tax obligations and support the overall functioning of the PAYE system.

Employee Declarations

When employees start a new job, they are required to provide their employers with relevant information, such as their National Insurance Number and tax code. The PAYE Tax Reference enables employers to link this information to the correct tax records and ensure accurate tax administration for their employees.

Tax Coding

Tax codes are used to determine the correct amount of tax to be deducted from an employee’s wages. The PAYE Tax Reference helps HMRC assign the appropriate tax codes to employers, ensuring that the correct amount of tax is deducted from employees’ salaries.

Common Issues Related to the PAYE Tax Reference

While the PAYE Tax Reference is generally reliable, there are some common issues that individuals may encounter. Here are a few examples:

Misspelled or Outdated Information

Sometimes, there may be errors in the spelling or formatting of the PAYE Tax Reference. Double-check the information provided by your employer to ensure its accuracy. If you suspect that the information is incorrect or outdated, notify your employer immediately to rectify the issue.

Changes in Employment Status

If you change jobs or your employment status changes, your previous employer’s PAYE Tax Reference may no longer be relevant to you. In such cases, ensure that you obtain the new tax reference number from your new employer to ensure accurate tax administration.

Frequently Asked Questions about the PAYE Tax Reference

Can I use my PAYE Tax Reference for filing tax returns?

No, the PAYE Tax Reference is specific to employers and is used for payroll and tax administration purposes. If you are required to file a tax return, you will need to use your Unique Taxpayer Reference (UTR) instead.

Is the PAYE Tax Reference the same as a National Insurance Number?

No, the PAYE Tax Reference and the National Insurance Number are two separate identifiers. While the PAYE Tax Reference is specific to employers and payroll, the National Insurance Number is assigned to individuals for social security and other purposes.

Can self-employed individuals have a PAYE Tax Reference?

Self-employed individuals do not have a PAYE Tax Reference. They are required to register for Self Assessment and obtain a Unique Taxpayer Reference (UTR) instead. The PAYE Tax Reference is specific to employers within the PAYE tax system.