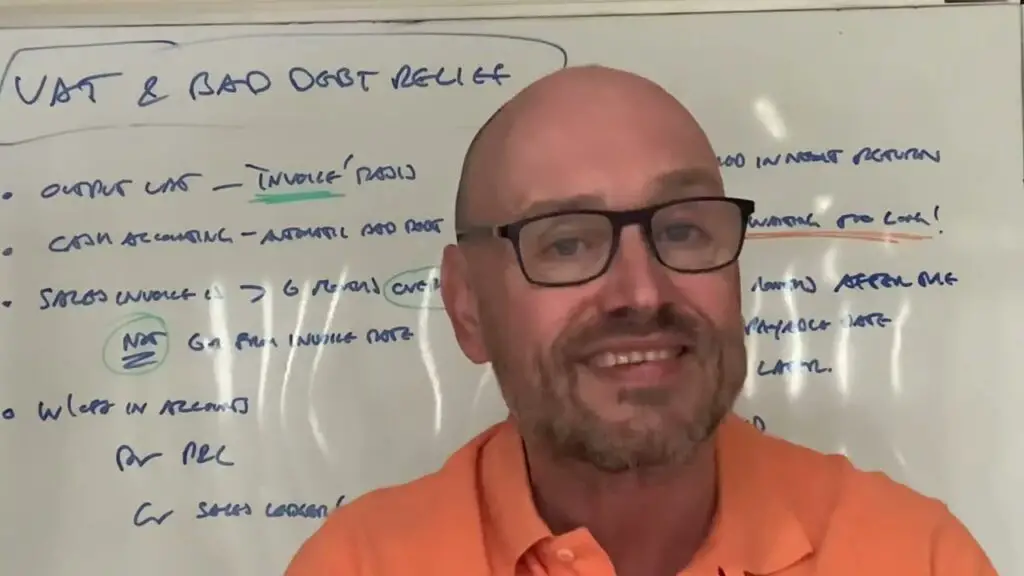

Have you ever struggled to recover VAT on bad debts in the UK? If so, you’re certainly not alone. It’s a challenge that many businesses face, and understanding the process can make a significant difference to your bottom line. In the article “Recovering VAT On Bad Debts In UK,” you’ll discover how UK businesses can reclaim VAT on unpaid debts, which can offer a much-needed financial relief. You’ll learn about the eligibility criteria and steps required for making a successful VAT adjustment, providing you with practical guidance and essential tips to handle these challenging situations. Whether you’re a seasoned business owner or new to the VAT game, this guide will ensure you’re well-equipped to navigate the complexities of reclaiming VAT on bad debts in the UK.

Welcome to this comprehensive guide that aims to unravel the complexities of recovering VAT on bad debts in the UK. We’ll explain the essential details and provide you with actionable insights, all in a friendly and conversational tone. So let’s dive into this crucial topic!

What is VAT and Why is it Important?

Value Added Tax (VAT) is a crucial part of the UK’s tax system. It is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. Both businesses and consumers are affected by VAT, making it a significant consideration for anyone involved in commerce.

How Does VAT Work?

Typically, businesses charge VAT on their sales and pay VAT on their purchases. The difference between these amounts is then paid to HMRC (Her Majesty’s Revenue and Customs). But what happens when your customer doesn’t pay you? Most businesses still have to pay VAT to HMRC, even if they haven’t received the payment from their customer. This is where recovering VAT on bad debts becomes essential.

Understanding Bad Debts

To grasp the concept of recovering VAT, you must first understand what constitutes a bad debt. In simple terms, a bad debt is any receivable that cannot be collected from the customer due to various reasons such as insolvency, bankruptcy, dispute or default.

Examples of Bad Debts

Real-world scenarios include:

- An invoice that has been outstanding for an extended period and is deemed uncollectible.

- A customer who has gone bankrupt and cannot settle their pending invoices.

- A disputed invoice where the customer refuses to pay, and all avenues for resolution have been exhausted.

The Legal Framework: VAT Bad Debt Relief

The UK tax system provides a mechanism known as VAT Bad Debt Relief, which allows businesses to reclaim the VAT on bad debts. Understanding the legislative framework can aid you in making the most of this relief.

Qualification Criteria

To qualify for VAT Bad Debt Relief, a business must meet certain conditions:

- The debt must be outstanding for at least six months.

- The debt must be written off in the business’s accounts.

- The VAT must have been accounted for and paid to HMRC.

Here’s a simple table to summarise the eligibility criteria:

| Criteria | Description |

|---|---|

| Minimum Period | Six months of non-payment |

| Accounting | Debt must be written off in accounts |

| VAT Status | VAT should have been paid to HMRC |

Timeline for Claiming

It’s crucial to know when you can claim this relief. You can make a claim within four years and six months from the later of:

- The date the payment was due.

- The date you provided the goods or services.

The Claim Process

Once you’ve met all the eligibility criteria, the next step is to make the actual claim. Knowing how to navigate this process ensures you can recover your losses effectively.

Step-by-Step Guide

- Identify Eligible Debts: Ensure the debts meet the criteria laid out earlier.

- Write Off Debt in Accounts: Make a record of the debt being written off in your financial accounts.

- Calculate the VAT: Determine the VAT that can be reclaimed from the unpaid invoices.

- Prepare Documentation: Ensure you have all the necessary documents, including original invoices and records of all collection efforts.

- Submit Claim: Use your VAT return to claim the VAT Bad Debt Relief. The amount will need to be included in the amount entered in Box 4 of your VAT return in the period that you make a claim for the bad debt relief.

- Adjust VAT Account: Make adjustments to your VAT account to reflect the reclaimed VAT.

Required Documentation

Keeping a thorough record is important for a smooth claim process. Here are the documents you will need:

- Original invoices

- Account statements

- Correspondence with the debtor

- Evidence of all collection efforts

Common Mistakes and How to Avoid Them

Even the slightest error in your VAT Bad Debt Relief claim can lead to complications. Here are some common mistakes and tips to avoid them:

Incorrect Calculations

One common mistake is miscalculating the amount of VAT that can be reclaimed. Ensure that your calculations are precise and based on the VAT rate at the time of the sale.

Incomplete Documentation

Another pitfall is incomplete documentation. Make sure to keep all relevant records in an organized manner. This not only helps in claiming relief but also serves as proof in case of an audit.

Ignoring Time Constraints

Remember, you have a limited window to make your claim. Missing the deadline can nullify your eligibility. Mark important dates in your calendar to avoid any delays.

How Technology Can Help

Today’s digital tools can significantly simplify the process of managing bad debts and recovering VAT.

Accounting Software

Using robust accounting software can assist in tracking debts, creating reminders for unpaid invoices, and managing write-offs within your financial records. Popular options include QuickBooks, Xero, and Sage.

Automated Reminders

Automated systems can also send reminders to customers about their pending debts, making it easier to follow up consistently.

Record Keeping

Digital record-keeping solutions can ensure that all necessary documents are stored securely and are easily accessible when needed for your VAT Bad Debt Relief claim.

Professional Assistance

If you’re finding the process exhausting, it might be beneficial to consult a tax professional or an accountant. Their expertise can guide you through the complexities and ensure that your claim is complete and accurate.

Reasons to Seek Professional Help

- Complex Cases: If your bad debt scenario involves complex disputes or legal issues.

- Time-Saving: Professionals can handle the process more efficiently.

- Accuracy: Reduces the likelihood of errors in your claim, ensuring maximum recovery.

Benefits of Recovering VAT on Bad Debts

Being able to reclaim VAT on bad debts can have several benefits for your business:

Financial Relief

Reclaiming VAT provides financial relief, freeing up cash flow and contributing to your overall financial health.

Compliance

Ensuring you claim VAT Bad Debt Relief correctly shows you are compliant with UK tax laws, which can be beneficial during audits and inspections.

Reduced Loss Impact

While bad debts can never be entirely eliminated, recovering the VAT can mitigate some of the financial impact, making it easier for your business to endure losses.

Practical Tips for Minimizing Bad Debts

While recovering VAT on bad debts is essential, an even better strategy is to minimize the occurrence of bad debts in the first place. Here are some practical tips:

Credit Checks

Perform credit checks on potential clients to ascertain their financial health before extending credit. This can be done through credit reference agencies.

Clear Payment Terms

Set clear and concise payment terms. Ensure they are communicated effectively to your clients at the beginning of the business relationship.

Regular Follow-Ups

Consistently follow up on outstanding invoices. Sometimes, a gentle reminder is all it takes for a client to settle their debt.

Offer Incentives

Consider offering early payment discounts as an incentive for clients to settle their invoices promptly.

Legal Resources

Don’t hesitate to use legal resources for persistent non-payers. Sometimes, a letter from a solicitor can prompt quick payment.

FAQs on Recovering VAT on Bad Debts

Can I claim VAT on part payments?

Yes, you can claim VAT Bad Debt Relief on the proportion of the debt that remains unpaid, provided you meet the eligibility rules.

What if the debtor later pays?

If a debtor later settles the debt after you have claimed VAT Bad Debt Relief, you must repay the VAT you reclaimed to HMRC.

Is there a minimum amount for bad debt relief?

There isn’t a specific minimum amount for claiming VAT Bad Debt Relief. However, the amount must be significant enough to warrant the administrative effort.

Can I claim VAT on invoices disputed by the client?

No, disputes must be resolved before you can claim VAT Bad Debt Relief. The debt must be undeniable and written off as bad in your accounts.

Does the relief apply to all types of supplies?

VAT Bad Debt Relief applies to standard-rated and reduced-rated supplies, but not to exempt supplies.

Conclusion

Recovering VAT on bad debts in the UK may seem complex, but understanding the right procedures and requirements can make it much more straightforward. From understanding the essentials of VAT and bad debts to navigating the claim process and avoiding common pitfalls, this guide aims to equip you with all the knowledge you need. Leveraging technology, seeking professional help when necessary, and taking proactive measures to minimize bad debts in the first place can further enhance your efforts.

By staying informed and diligent, you can recover the VAT on your bad debts efficiently, providing vital financial relief for your business. Feel empowered to take the next steps for your business’s financial well-being and compliance.

So, what are you waiting for? Review your accounts, gather your documentation, and start the process of reclaiming the VAT you rightfully deserve!