Understanding the UK tax system, especially aspects like the P800 tax refund, can seem daunting. But don’t worry – you’re in the right place. Let’s take this journey together, and I’ll walk you through everything you need to know.

What is a P800 Tax Refund?

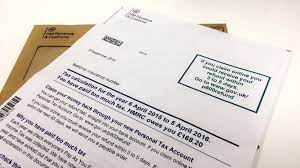

First things first, let’s clear up what a P800 tax refund is. Simply put, it’s a form that HM Revenue and Customs (HMRC) sends out when they believe you’ve paid too much or too little tax. Yes, tax overpayment can happen! This usually occurs under the PAYE (Pay As You Earn) system when your tax code or personal tax allowance calculations go haywire.

So, when might you receive a P800? Well, it can land in your mailbox if there have been changes in your employment, or if there’s been a blip with your tax code. Unexpected, but not an unwelcome surprise, right?

Understanding the P800 Tax Refund Process

Navigating the P800 tax refund process can seem like a bit of a puzzle, but once you understand the ins and outs, it’s pretty straightforward. HMRC usually sends out the P800 tax calculation between June and October following the end of the tax year, which wraps up in April.

Received your P800 tax calculation? Great! It’s time to take some steps. If you’ve overpaid tax, the form will show you how to claim your tax refund. If you’ve underpaid, don’t fret – it’ll explain how you can pay back what you owe. Either way, you’re covered!

Common Reasons for Receiving a P800 Tax Refund

There are several reasons why you might receive a P800. A change in employment is a common one, as it can mix up your tax code, leading to tax overpayment or underpayment. Likewise, if there’s been a mistake with your tax code, it could result in a P800 tax calculation. Remember, the taxman wants you to pay what’s due – no more, no less!

What to Do If You Haven’t Received Your P800 Tax Refund

Now, you might be wondering, what if I haven’t received my P800 tax refund, but I think I’m eligible? Good question! If you believe you’ve overpaid tax but haven’t received a P800 by the end of November, you can contact HMRC directly. They’ll check your tax records and guide you on how to claim your refund if you’re eligible.

Mistakes to Avoid When Claiming Your P800 Tax Refund

Claiming your P800 tax refund should be smooth sailing. But like any process, there can be hiccups. One common mistake is ignoring the P800 tax calculation form. Make sure you review it thoroughly and take the necessary steps outlined. And remember, if you’re unsure about anything, it’s always best to contact HMRC or a tax professional for guidance.

The Impact of P800 Tax Refund on Your Finances

A tax refund can bring a smile to your face, but it’s crucial to handle this unexpected money wisely. A sudden influx of cash can impact your financial status, so think about how best to use it. It could be a good idea to pay off debts, save for a rainy day, or invest in your future.

Conclusion

And that wraps up our dive into the P800 tax refund! The UK tax system, including tax laws and tax return processes, can be complex, but understanding the fundamentals is the first step to navigating it like a pro. Remember, if you’re due a refund, it’s your hard-earned money – make sure you claim it!

Final word

Now, over to you! If you’ve found this helpful, why not share the knowledge? Or if you’ve got any burning questions or experiences to share, drop a comment below. And remember, if you’re unsure about your P800 tax refund, seeking professional advice is always a good call.

Frequently Asked Questions

What is a P800 tax refund? It’s a form from HMRC that lets you know if you’ve paid too much or too little tax under the PAYE system.

How does the P800 tax refund process work? If you’ve overpaid tax, HMRC sends you a P800 tax form with instructions on how to claim your refund. If you’ve underpaid, the P800 will detail how you can pay back the owed amount.

What should I do if I haven’t received my P800 tax refund? If you believe you’ve overpaid tax but haven’t received a P800 by the end of November, you can contact HMRC to check your tax records.

How can a P800 tax refund impact my finances? A tax refund can boost your finances. It’s crucial to consider how best to use this money, such as paying off debts, saving, or investing.

Who should I contact if I have questions about my P800 tax refund? You can reach out to HMRC or a tax professional for advice if you have any queries about your P800 tax refund.