In the world of finance and accounting, the importance of maintaining an accurate and up-to-date record of fixed assets cannot be overstated. Whether you work for a small business or a large corporation, having a comprehensive Fixed Asset Register is crucial for effective asset management and financial reporting. This register serves as a centralized database that outlines vital details such as the acquisition cost, useful life, and depreciation of each fixed asset within an organization. By providing a concise overview of this crucial tool, this article aims to shed light on the importance and benefits of having a well-maintained Fixed Asset Register.

What is a Fixed Asset Register?

Definition

A fixed asset register, also known as a fixed asset ledger, is a comprehensive record of an organization’s tangible assets that are expected to provide economic benefits over a long period of time. It serves as a database or inventory of all fixed assets owned by the organization, such as land, buildings, vehicles, machinery, and equipment.

Purpose of Fixed Asset Register

The primary purpose of a fixed asset register is to provide an organization with an accurate and up-to-date inventory of its fixed assets. This register enables efficient management of assets throughout their lifecycle, supports accurate financial reporting, and ensures compliance with regulatory requirements.

Components

A fixed asset register typically includes several key components. These may include:

- Asset Descriptions: Detailed descriptions of each fixed asset, including its type, make, model, and relevant specifications.

- Purchase Information: Information related to the acquisition of each asset, such as purchase date, vendor, and cost.

- Location Details: The physical location of each asset, including the department, building, and room where it is located.

- Depreciation and Amortization: Information on the depreciation and amortization methods used to calculate the wear and tear or depletion of each asset over time.

- Maintenance and Service Records: Documentation of any maintenance or service activities conducted on the asset, including dates, costs, and notes.

- Disposal or Sale Information: Details of any asset disposals or sales, including the date, method, and proceeds received.

Importance of a Fixed Asset Register

Effective Asset Management

A well-maintained fixed asset register enables effective asset management by providing organizations with a clear overview of their asset portfolio. By having accurate and detailed information on each fixed asset, organizations can make informed decisions regarding asset maintenance, replacement, and disposal. This allows for better forecasting and planning, ultimately maximizing the value and lifespan of assets.

Accurate Financial Reporting

A fixed asset register plays a crucial role in accurate financial reporting. By recording the cost and depreciation of each asset, organizations can determine the value of their fixed assets and accurately reflect them in their financial statements. This ensures compliance with accounting standards and provides stakeholders with reliable and transparent financial information.

Compliance with Regulatory Requirements

Maintaining a fixed asset register helps organizations comply with regulatory requirements, such as those imposed by tax authorities and financial regulatory bodies. Accurate records of fixed assets enable organizations to calculate depreciation expenses, track capital gains or losses, and ensure proper tax reporting. Additionally, a complete and well-maintained register aids in meeting audit and disclosure requirements, reducing the risk of penalties and legal issues.

Creating a Fixed Asset Register

Identifying Fixed Assets

The first step in creating a fixed asset register is to identify all the tangible assets that meet the criteria of being a fixed asset. This involves conducting a thorough physical inspection of all assets owned by the organization. Assets that are likely to provide economic benefits beyond one reporting period should be included, while consumable or non-durable assets should be excluded.

Gathering Asset Information

Once the fixed assets have been identified, it is essential to gather detailed information about each asset. This includes information such as the asset description, purchase date, purchase cost, serial number, and any relevant supporting documents. This information can be obtained from purchase invoices, contracts, and equipment manuals.

Categorizing Assets

To organize and manage fixed assets effectively, it is crucial to categorize them based on their type, function, or other relevant criteria. Common asset categories may include land, buildings, vehicles, machinery, and office equipment. By categorizing assets, organizations can easily locate and track specific types of assets, simplifying asset management processes.

Assigning and Tracking Unique Asset IDs

Assigning unique asset identification numbers to each fixed asset is a vital step in maintaining an accurate fixed asset register. These identification numbers serve as a reference for tracking and locating assets and should be affixed to each asset using labels or tags. Organizations can implement a standardized numbering system to ensure consistency and ease of asset identification.

Recording Asset Details

Once all the necessary information has been gathered, it is essential to record it in the fixed asset register. This should include asset descriptions, purchase details, location information, and any other relevant information. The register should be maintained in a structured format, such as a spreadsheet or specialized asset management software, allowing for easy search and retrieval of asset information.

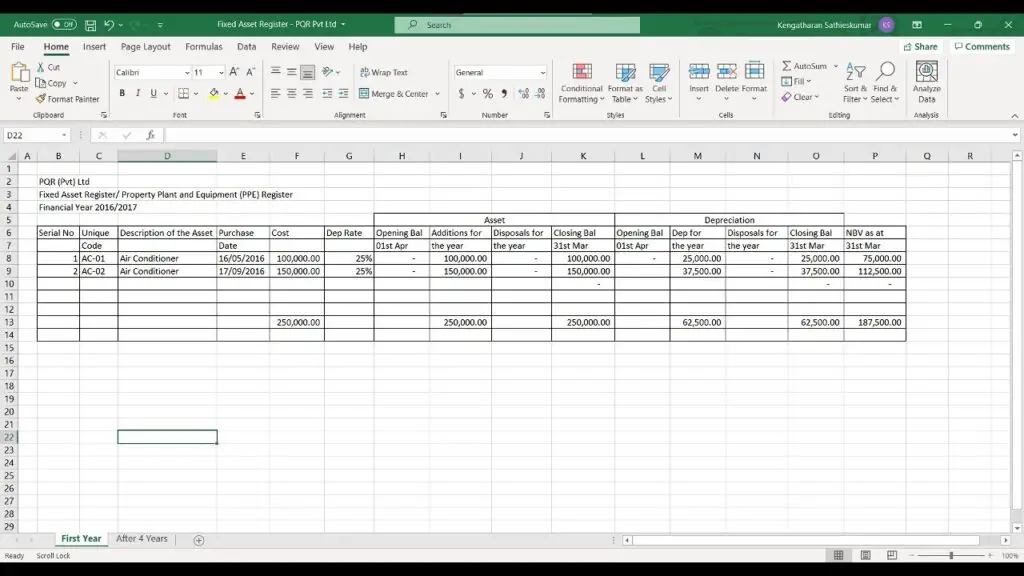

Example of a Fixed Asset Register

Here’s a detailed example of what a Fixed Asset Register might look like:

| Asset ID | Description | Date Acquired | Cost ($) | Useful Life (Years) | Depreciation Method | Accumulated Depreciation ($) | Net Book Value ($) | Location | Asset Status |

|---|---|---|---|---|---|---|---|---|---|

| 001 | Office Computer | 01/01/2020 | 1,000 | 5 | Straight-Line | 400 | 600 | Office Room 1 | In Use |

| 002 | Company Vehicle | 15/03/2019 | 20,000 | 8 | Reducing Balance | 5,000 | 15,000 | Parking Lot | In Use |

| 003 | Office Desk | 10/06/2021 | 500 | 10 | Straight-Line | 50 | 450 | Office Room 2 | In Use |

| 004 | Photocopier | 05/09/2019 | 2,500 | 7 | Straight-Line | 714.29 | 1,785.71 | Copy Room | In Use |

| 005 | Factory Machine | 20/11/2018 | 50,000 | 10 | Reducing Balance | 15,000 | 35,000 | Factory Floor | Under Repair |

This is a basic example, and real-world Fixed Asset Registers can have additional columns or details based on the company’s requirements.

Updating and Maintaining a Fixed Asset Register

Regular Physical Verification

To maintain the accuracy of the fixed asset register, it is essential to conduct regular physical verification of assets. This involves physically inspecting each asset, verifying its existence, and checking its condition. Any discrepancies or missing assets should be promptly investigated and resolved to ensure the register remains up to date.

Adjusting for Asset Additions and Disposals

As assets are added or disposed of, it is crucial to update the fixed asset register accordingly. When new assets are acquired, their details should be recorded in the register along with supporting purchase documents. Similarly, when assets are disposed of or sold, the register should be updated to reflect the changes. This ensures that the register accurately reflects the organization’s current asset holdings.

Depreciation and Impairment Considerations

Depreciation and impairment should be regularly assessed and recorded in the fixed asset register. Depreciation is the process of allocating the cost of an asset over its useful life, while impairment refers to a decrease in the asset’s value due to obsolescence, damage, or other factors. Updating the fixed asset register with accurate depreciation and impairment figures ensures the financial statements reflect the true value of the assets.

Reconciling with Financial Records

To maintain the integrity and accuracy of the fixed asset register, it is essential to regularly reconcile it with the organization’s financial records. This includes comparing the register’s asset values with those in the general ledger and identifying any discrepancies. Reconciliation helps identify errors or omissions, allowing for prompt corrective action and ensuring financial statements are reliable.

Benefits of a Well-Maintained Fixed Asset Register

Streamlined Accounting Processes

A well-maintained fixed asset register streamlines accounting processes by providing accurate information about fixed assets. This simplifies the calculation of depreciation expenses, tracking of asset values, and preparation of financial statements. It also reduces the time and effort required for audits and enables reliable reporting for tax purposes.

Effective Cost Management

A comprehensive fixed asset register allows organizations to effectively manage costs associated with fixed assets. By tracking asset values, depreciation, and maintenance costs, organizations can identify potential cost-saving opportunities, optimize asset utilization, and budget effectively for asset maintenance, repairs, and replacements.

Improved Decision Making

Accurate and detailed asset information provided by a fixed asset register enables informed decision-making. Organizations can analyze the performance, maintenance history, and remaining useful life of assets to make informed choices regarding repairs, replacements, and upgrades. This helps optimize asset allocation, enhance operational efficiency, and support strategic planning for the future.

Enhanced Asset Tracking and Security

A well-maintained fixed asset register enhances asset tracking and security. By recording asset details, location information, and custodial responsibility, organizations can easily track the movement and usage of assets. This reduces the risk of loss, theft, or misuse of assets and promotes accountability among employees. Additionally, in the event of an audit or insurance claim, the fixed asset register serves as crucial evidence of asset ownership and value.

Common Challenges in Maintaining a Fixed Asset Register

Inaccurate or Incomplete Data

One of the most common challenges in maintaining a fixed asset register is the presence of inaccurate or incomplete data. This can occur due to errors in data entry, lack of proper documentation, or inadequate training of staff responsible for maintaining the register. Inaccurate data can lead to financial misstatements, compliance issues, and inefficiencies in asset management processes.

Lack of Proper Documentation

Without proper documentation, it can be challenging to maintain an accurate fixed asset register. This includes missing purchase invoices, contracts, or warranty information, making it difficult to verify asset details and value. Proper documentation is essential for accurately recording asset information, calculating depreciation, and supporting financial reporting.

Lack of Regular Updates

If the fixed asset register is not regularly updated, it can quickly become outdated and unreliable. Failure to update the register with new asset acquisitions, disposals, or changes in asset details can lead to inaccurate financial reporting, inefficient asset management, and noncompliance with regulatory requirements. Regular updates ensure the register reflects the current state of the organization’s asset holdings.

Managing Asset Disposal and Write-Offs

Managing asset disposals and write-offs can be a complex task. When assets reach the end of their useful life or become obsolete, they need to be properly disposed of or written off. This requires adherence to specific accounting standards and regulatory requirements. Failure to manage asset disposals and write-offs appropriately can result in inaccurate financial reporting and noncompliance with accounting principles.

Using Technology for Fixed Asset Register Management

Asset Management Software

Asset management software provides organizations with a centralized and automated solution for maintaining a fixed asset register. This software streamlines data entry, updates, and reporting processes, reducing the risk of errors and ensuring data accuracy. It can also offer features such as barcode scanning, integration with accounting systems, and customizable reporting, enhancing the efficiency and effectiveness of fixed asset management.

Barcode and RFID Technology

Barcoding and RFID technology improve the accuracy and efficiency of asset tracking and management. By affixing barcode labels or using RFID tags, assets can be easily identified and tracked throughout their lifecycle. This technology enables faster asset audits, reduces manual data entry errors, and improves the overall accuracy of the fixed asset register.

Integration with Accounting Systems

Integration between the fixed asset register and the organization’s accounting system is essential for seamless financial reporting. This integration ensures that changes in asset values, depreciation, disposals, and additions are automatically updated in the general ledger. It eliminates the need for manual data entry, reduces the risk of errors, and facilitates accurate and timely financial reporting.

Best Practices for Managing a Fixed Asset Register

Establishing Clear Policies and Procedures

Clear policies and procedures should be established for maintaining a fixed asset register. These should define roles, responsibilities, and processes for asset identification, data entry, updates, and reconciliation. By having clearly defined guidelines, organizations can ensure consistency and accuracy in managing the fixed asset register.

Training Staff for Data Entry and Verification

Proper training for staff responsible for data entry and verification is crucial for maintaining an accurate fixed asset register. This includes providing training on asset identification, data entry procedures, and reconciliation processes. Regular refresher training should also be conducted to keep staff updated on any changes in policies or procedures.

Regular Audits and Reviews

Regular audits and reviews of the fixed asset register are essential to ensure data accuracy and compliance. Internal audits can help identify any discrepancies or errors in the register, while external audits provide independent verification of the register’s accuracy. Regular reviews also help identify opportunities for process improvements and ensure ongoing compliance with regulatory requirements.

Data Backup and Security Measures

Data backup and security measures should be implemented to protect the integrity of the fixed asset register. Regular backups of the register should be performed to prevent data loss in the event of system failures or disasters. Access controls, user permissions, and encryption should be used to restrict access to the register and protect sensitive asset information from unauthorized individuals.

Auditing the Fixed Asset Register

Internal vs External Audits

Auditing the fixed asset register can be conducted internally by an organization’s internal audit team or externally by a third-party auditor. Internal audits provide independent and objective assessment, ensuring data accuracy and compliance with internal policies. External audits, on the other hand, offer an unbiased evaluation of the register’s accuracy and compliance with accounting standards and regulatory requirements.

Importance of Auditing

Auditing the fixed asset register is essential to verify its accuracy and reliability. It helps identify any discrepancies, errors, or inconsistencies in asset data, ensuring that financial statements are accurate and trustworthy. Auditing also provides assurance to stakeholders, including owners, investors, and regulators, that the organization’s fixed asset register is managed effectively and in compliance with relevant standards and regulations.

Ensuring Accuracy and Compliance

Auditing the fixed asset register involves a thorough review of asset details, supporting documentation, and compliance with accounting standards and regulations. The auditor will perform asset verification, test the accuracy of depreciation calculations, reconcile the register with financial records, and ensure compliance with relevant policies and regulations. Any discrepancies or noncompliance found during the audit should be promptly addressed and resolved.

Potential Consequences of Poor Fixed Asset Register Management

Financial Losses and Misreporting

Poor management of the fixed asset register can result in financial losses and misreporting. Inaccurate asset data can lead to incorrect financial statements, inaccurate depreciation calculations, and misreported financial performance. This can negatively impact decision-making, investor confidence, and the overall financial health of the organization.

Noncompliance Penalties and Legal Issues

Inadequate maintenance and noncompliance with regulatory requirements can result in penalties and legal issues. Failure to accurately report fixed assets, their depreciation, and disposals can lead to tax penalties, fines, and audits by regulatory authorities. Noncompliance with accounting standards can result in legal disputes, damage to the organization’s reputation, and loss of investor trust.

Inefficient Resource Allocation

Poor management of the fixed asset register can lead to inefficient resource allocation. Without accurate information on asset values, condition, and maintenance requirements, organizations may allocate resources inefficiently, resulting in unnecessary expenses or inadequate maintenance. This can lead to higher costs, reduced asset lifespan, and decreased operational efficiency.

In conclusion, a well-maintained fixed asset register is critical for effective asset management, accurate financial reporting, and compliance with regulatory requirements. By identifying fixed assets, gathering detailed information, categorizing assets, and recording asset details, organizations can establish a comprehensive register. Regular updates, physical verification, and reconciliation with financial records ensure the register remains accurate and reliable. The use of technology, such as asset management software and barcode technology, streamlines the management of the register. Implementing best practices, conducting regular audits, and addressing common challenges ensure the register’s accuracy and compliance. Failure to manage the fixed asset register properly can result in financial losses, noncompliance penalties, and inefficient resource allocation. Therefore, organizations should prioritize the maintenance of a well-managed fixed asset register to maximize the value of their assets and support their long-term success.