Hello there! Updating your bank details with HMRC can seem like a daunting task, but fear not, I’m here to guide you through the process step by step. By making sure your information is accurate and up to date, you can ensure that any payments or refunds from HMRC get to you promptly and smoothly. Let’s get started on the journey to updating your bank details with HMRC and ensuring your financial affairs are in order. It’s easier than you think!

How to Update Your Bank Details with HMRC

Have you recently changed bank accounts and need to update your information with HMRC? Don’t worry! I’m here to guide you through the process step by step.

Why Do You Need to Update Your Bank Details with HMRC?

It’s essential to keep your bank details up to date with HMRC to ensure that any refunds, payments, or communication from them are sent to the right place. Failure to update your information could lead to delays or even missing out on important information.

Where to Update Your Bank Details

To update your bank details with HMRC, you can do so online through their website. This is the quickest and easiest way to ensure that your information is updated promptly.

Step-by-Step Guide to Updating Your Bank Details Online

- Log in to Your HMRC Online Account Visit the HMRC website and log in to your online account using your details. If you don’t already have an account, you will need to create one before proceeding.

- Navigate to the “Manage Account” Section Once logged in, you should see an option to manage your account. Click on this section to access the options for updating your bank details.

- Select “Change Bank Details” Look for the option to change your bank details within the manage account section. Click on this option to begin the process.

- Enter Your New Bank Details You will be prompted to enter your new bank account details. Make sure to double-check the information to avoid any errors.

- Verify Your Identity To ensure the security of your account, you may be asked to verify your identity through a text message or email confirmation.

- Submit Your Updated Bank Details Once you have entered and verified your new bank details, submit the information for HMRC to update their records.

Updating Bank Details for VAT Purposes

If you are a VAT-registered business, there are specific steps you need to follow to update your bank details for VAT purposes.

Updating Bank Details for VAT Online

- Log in to Your VAT Online Account Access your VAT online account through the HMRC website using your credentials.

- Go to “VAT Details” Within your VAT account, navigate to the section that contains your VAT details.

- Update Bank Details Look for the option to update your bank details for VAT payments. Enter your new information and confirm the changes.

- Verify Your Identity As an added security measure, you may need to verify your identity before the changes can be processed.

- Submit the Changes Once you have completed the steps above, submit the changes to ensure that your new bank details are updated for VAT payments.

Updating Bank Details for Self-Assessment

If you file self-assessment tax returns, it’s crucial to update your bank details with HMRC to ensure that any refunds or payments are sent to the correct account.

Updating Bank Details for Self-Assessment Online

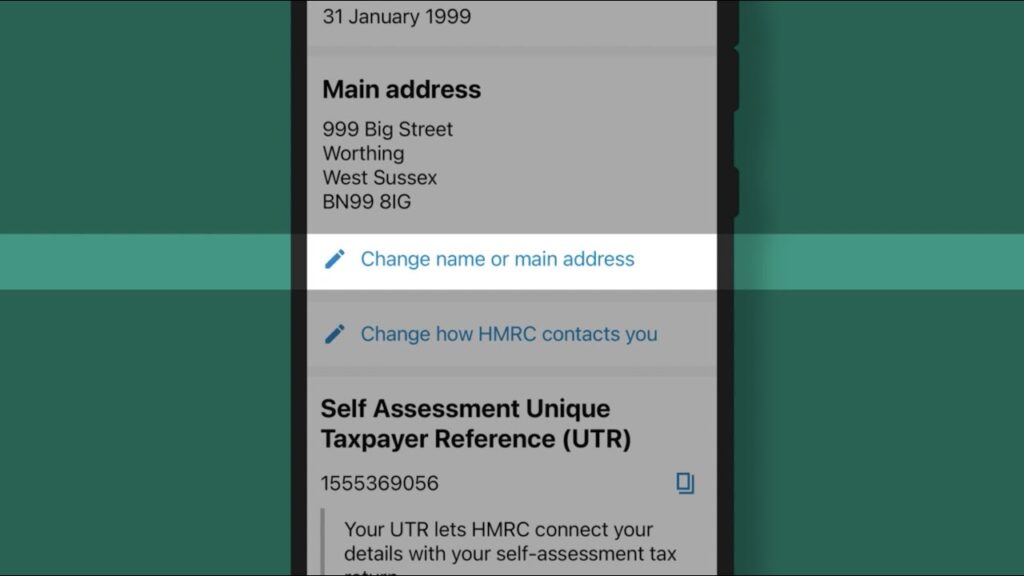

- Log in to Your Self-Assessment Account Access your self-assessment account through the HMRC website using your login details.

- Navigate to “Bank Details” Look for the section that contains your bank details within your self-assessment account.

- Enter Your New Bank Details Update your bank account information with the new details to ensure that future payments are processed correctly.

- Verify Your Identity Verify your identity through the required verification process to confirm the changes.

- Submit the Updated Bank Details Once you have updated and verified your new bank details, submit the information to HMRC for processing.

Common Errors to Avoid When Updating Your Bank Details with HMRC

When updating your bank details with HMRC, there are some common errors to avoid to ensure a smooth process.

- Entering Incorrect Bank Details Double-check the information you enter to avoid any errors in your bank account details.

- Failure to Verify Identity Make sure to complete the verification process to confirm your identity and avoid any delays in updating your information.

- Forgetting to Submit Changes After entering and verifying your new bank details, remember to submit the changes to HMRC for processing.

FAQ About Updating Bank Details with HMRC

How Long Does It Take for Bank Details to Be Updated?

The time it takes for your bank details to be updated with HMRC can vary. In most cases, the changes should reflect within a few business days.

Will I Receive Confirmation of the Bank Details Update?

Once you have submitted your new bank details to HMRC, you should receive a confirmation email or notification that the changes have been processed.

What Happens If I Close My Bank Account?

If you have closed the bank account linked to your HMRC details, make sure to update your information promptly to avoid any issues with future payments or refunds.

In Conclusion

Updating your bank details with HMRC is a simple process that can be done online through their website. By following the steps outlined in this article, you can ensure that your information is up to date and accurate for any payments, refunds, or communication from HMRC. Remember to verify your identity and avoid common errors to make the process smooth and efficient. If you have any additional questions or need assistance, don’t hesitate to reach out to HMRC for help.