Guide to Accessing Your HMRC Online Account

Are you trying to access your HMRC online account but aren’t sure how to get started? You’re not alone. Navigating the process of setting up and managing your HMRC (Her Majesty’s Revenue and Customs) online account can seem difficult at first. However, with the right guidance, you can make the process smooth and straightforward. This guide aims to help you access your account with ease and make the most of the services available.

Why Do You Need an HMRC Online Account?

An HMRC online account is your gateway to a variety of tax services. With a few clicks, you can:

- File your Self Assessment tax return

- Check your tax code

- Review your Income Tax

- Claim tax relief

- Manage tax credits and child benefits

- View and update your personal details

Having an online account saves time and simplifies many interactions with HMRC, allowing you to manage your taxes more efficiently.

Prerequisites for Setting Up an HMRC Online Account

Before you start, gather the following information to ensure a smooth registration process:

- Your National Insurance Number: This is crucial for individual registrations.

- A valid UK address: Ensure it’s up-to-date.

- Email Address: An active email address for communications.

- Phone Number: A mobile or landline number that you can use for security verifications.

- Government Gateway User ID: If you have registered for any UK government online service before, you should have a Government Gateway User ID. If not, you will need to create one during the registration process.

How to Set Up Your HMRC Online Account

Step 1: Visit the HMRC Website

Go to the official HMRC website (gov.uk). Be cautious of scam websites and ensure you’re on the legitimate government website.

Step 2: Select “Sign in” or “Create an Account”

On the homepage, you’ll find options to sign in or create an account. Since you might be a new user, click on “sign in or set up”.

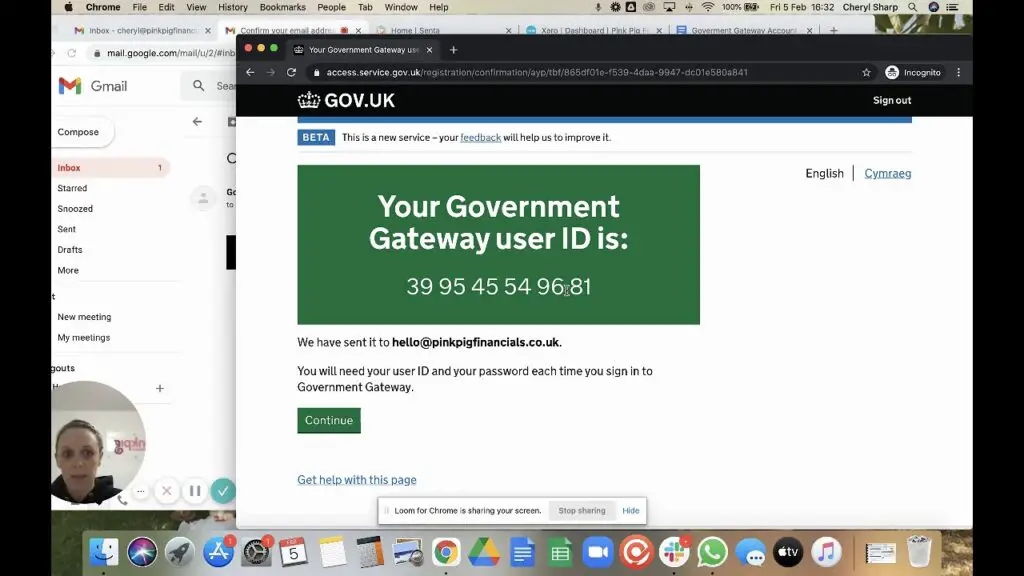

Step 3: Access the Government Gateway

You will be redirected to the Government Gateway page. Here, you need to either log in with your existing Government Gateway User ID or create a new one.

Step 4: Provide Your Information

Here, you will be asked to provide the necessary information like your full name, National Insurance Number, and date of birth. Make sure all information is accurate.

Step 5: Set Up Security Measures

To secure your account, you need to choose a password and set up recovery questions. Opt for a strong password and answers that you can easily remember but are hard for others to guess.

Step 6: Receive Your User ID

After successfully entering your details, you will receive a unique Government Gateway User ID by email. Note this down as you will need it for future logins.

Step 7: Activation Code

HMRC will send you an activation code via email. This code is needed to finalize your account setup. Enter the code once you receive it.

Logging Into Your HMRC Online Account

Step 1: Go to the HMRC Login Page

Return to the official HMRC website and click on “Sign in”.

Step 2: Enter Your Government Gateway User ID and Password

Input your unique Government Gateway User ID and the password you created during the setup.

Step 3: Security Verification

For added security, you’ll need to verify your identity. HMRC may send a security code to your registered mobile number or email.

Step 4: Access Your Account Dashboard

After completing the security verification, you will land on your HMRC account dashboard, where you can access all available services.

Navigating Your HMRC Online Account

Once you’re logged in, the dashboard can be a bit overwhelming. Here are the primary sections you will likely use:

Income Tax

You can view and manage your tax obligations here. This section provides a summary of your tax payments, tax code, and any reliefs you are entitled to.

Self Assessment

If you’re self-employed or need to file a Self Assessment tax return, you’ll handle it here. You can complete your tax return online and submit it directly through the portal.

National Insurance

This is where you can check your National Insurance contributions, view your statement, and ensure that you’re on track for your State Pension.

Tax Credits

Manage your tax credits, report changes in circumstances, and check the status of your payments.

Child Benefit

If you receive Child Benefit, use this section to manage your claims and review payments.

Trouble Logging In? Here’s What to Do

Sometimes, you might face issues logging in. Here are some common solutions:

Forgotten User ID or Password

If you’ve forgotten your Government Gateway User ID or password, you can recover them through the “forgotten ID/password” link on the login page. Be prepared to answer security questions to verify your identity.

Locked Account

Your account may be locked if there are multiple unsuccessful login attempts. Contact HMRC support for assistance in unlocking your account.

Security Tips for Your HMRC Online Account

Use Strong Passwords

Select a password that includes a mixture of letters, numbers, and special characters.

Enable Two-Factor Authentication

Add an extra layer of security by enabling two-factor authentication (2FA) whenever possible.

Regularly Update Your Password

Changing your password every few months is a good practice to maintain account security.

How to Update Your Personal Details

Step 1: Log In

Log in to your HMRC online account.

Step 2: Go to the “Your Profile” Section

Navigate to the “Your Profile” section in your account dashboard.

Step 3: Update Details

You can update your contact information, address, and other personal details here.

FAQs About HMRC Online Account

To make things even more straightforward, here are answers to some frequently asked questions.

Can I Access My Account from a Mobile Device?

Yes, HMRC’s website is mobile-friendly, and you can easily access your account from a smartphone or tablet.

What Do I Do if I Do Not Receive the Activation Code?

If you do not receive the activation code via email, check your spam folder. If it was supposed to arrive by post and hasn’t, contact HMRC for assistance.

Can I Add Multiple Services to My Account?

Yes, once you have set up your account, you can add multiple services like Self Assessment, PAYE for employees, VAT, and more.

When to Contact HMRC Support

If you encounter issues that you cannot resolve on your own, it may be time to contact HMRC support. Common reasons include:

- Problems receiving the activation code

- Issues with your National Insurance number

- Trouble accessing specific services within your account

- Locked or disabled account

Conclusion

Accessing and managing your HMRC online account doesn’t have to be complicated. By following these steps, you can easily set up your account, log in securely, and navigate through the various services with confidence. Whether you need to file your taxes, check your National Insurance contributions, or manage tax credits and child benefits, your HMRC online account provides a convenient and efficient way to handle your financial responsibilities.