Navigating the labyrinthine world of taxation can be a daunting task for employees. Amidst the jargon and paperwork, one term that often goes unnoticed is the Employers PAYE Reference Number. Yet, this seemingly obscure identifier holds significant importance, especially when you’re looking to claim tax relief on employment expenses or complete a self assessment tax return.

The Employer PAYE Reference Number serves various purposes for your employer in the tax system, and it’s crucial for various tax-related processes. Whether you’re filling out a P87 form to claim tax relief on employment expenses, setting up a Personal Tax Account, or simply trying to apply for a mortgage, this number is often indispensable.

In this article, we’ll demystify the Employer PAYE Reference Number, exploring its significance, where to find it, and why it’s essential for both employers and employees. So, buckle up as we delve into the nitty-gritty of this crucial yet often overlooked aspect of employment taxation.

What is a PAYE Reference Number?

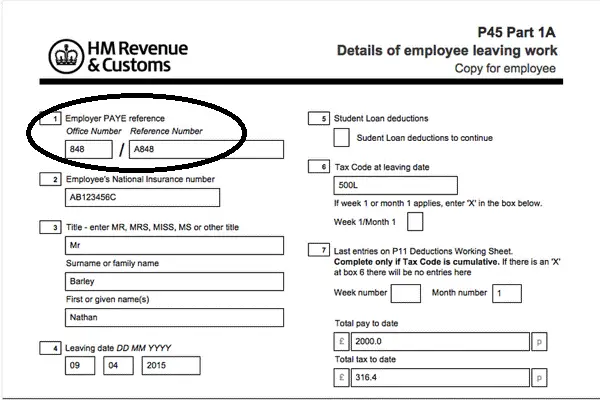

A PAYE Reference Number, also known as an Employer Reference Number, is a unique identifier for your employer in the HMRC system. It consists of two parts:

- Tax Office Identifier: Three digits that specify which tax office manages your employer.

- Employer Identifier: A combination of letters and/or numbers unique to your employer.

Example: 123/AA6543

Where to Find Your PAYE Reference Number

On Official Documents

- Payslips: Some employers include it in their employees payslip, although it’s not legally required.

- P60 or P45: Useful if you’ve been with your employer long enough to receive these documents.

Online: Personal Tax Account (PTA)

- Log in to your personal tax account.

- Select “Pay As You Earn (PAYE)” from the home page.

- Locate your Employer PAYE reference number under “PAYE Income Tax history.”

Note: If you don’t have a Personal Tax Account, you can easily setup one by going to HMRC website and registering for one. The process is easy as all the necessary instruction are provided

Ask Your Employer

If you’re unable to find it through any of these methods, consider asking your employer directly. Most employers will have no problem providing their employer reference number to their employer both past and present.

Troubleshooting

Can’t Access Personal Tax Account?

If you’re unable to access your Personal Tax Account, you can still get your employer’s PAYE reference by calling HMRC directly.

Conclusion

In the intricate web of employment taxation, the Employer PAYE (Pay As You Earn) Reference Number might appear as just another string of letters and numbers. However, as we’ve explored in this article, its role is far more pivotal. This unique identifier not only helps the HMRC keep track of your employer’s tax obligations but also serves as a key to unlock various financial situations for you, the employee.

Understanding where to find this number and how to use it can streamline the process of claiming tax relief, setting up a Personal Tax Account, and even resolving tax-related issues. While it may not be the most talked-about topic, its importance in the realm of employment and taxation is undeniable.

If you haven’t already, take a moment to locate your Employer’s PAYE Reference Number. Keep it handy for future tax-related activities, and don’t hesitate to ask your employer or consult online resources if you’re having trouble finding it. After all, this small piece of information can make a big difference when it comes to your financial well-being.