Performing a bank statement reconciliation is a crucial step in your business’s financial management. Using the correct procedure, you will be able to spot any errors or discrepancies in your financial records. In this article, we’ll explore the steps involved in completing the process. By the end, you’ll have the information you need to make informed decisions regarding your business’ finances. Regardless of whether your company has a paper-based or electronic bank statement, the steps to conduct a bank statement reconciliation are the same.

What is bank statement reconciliation?

Bank reconciliation is the process of comparing the balances in your bank accounts to what you find on your bank statements. It is a vital step for your business to ensure that all the money you have in your bank accounts is recorded in you cashbook or nominal ledger.

When you’re reconciling your bank statement, you need to match up the deposits in your records with what you’ve received on your bank statements. At the same time you need to match up the outgoings in you records with what was paid out on your bank statements. If there are any discrepancies, you need to find the reasons why and adjust your bank’s ending cash balance accordingly. If you’re not sure, your bank may have rejected a cheque from a batch of deposited cheques or recorded it differently. It’s important to verify your information thoroughly before proceeding.

Performing a bank statement reconciliation is crucial for many reasons. Not only does it ensure that you’re recording your business transactions properly and, it also helps prevent the loss of revenue by identifying unusual transactions. There are many types of reconciliation, from formal to informal, but every process has its benefits. Reconciling your bank statements is essential for any business or individual, whether you’re preparing financial statements for taxes or observing cash flow projections. For example, restaurants and retail stores process large amounts of cash and require daily reconciliations. Small online stores need a monthly or weekly reconciliation.

Bank statement reconciliation is an important part of accounting and can be done monthly, quarterly, or annually. This process involves reviewing documents and analytics. In the case of small businesses, bank statement reconciliation is a critical step to ensure that recorded balances match up with the actual amounts. Many audit firms will request a comprehensive year-end bank statement reconciliation as part of their annual financial audit processes. The steps involved in a bank statement reconciliation are similar to those used by bookkeepers.

As with any financial management task, performing a bank statement reconciliation can be a daunting task, but it’s important to remember that every small error can lead to serious problems. To avoid these problems, you should schedule the bank statement reconciliation process as a regular task. A good practice is to perform it at least monthly. Alternatively, if you have a higher volume of business, you can conduct it weekly or daily. If you don’t feel comfortable with the process, you can always opt for an online tool to make the task easier.

During this process, you should carefully review all your receipts. You should keep all the receipts for any purchases you made on your bank account. In this way, you will be able to identify any new charges and reconcile them against the actual account balance. However, you should not forget to keep the receipts for small charges, such as lunches. If you’re looking for such a situation, bank statement reconciliation will be invaluable for your business.

How To Perform A Bank Statement Reconciliation

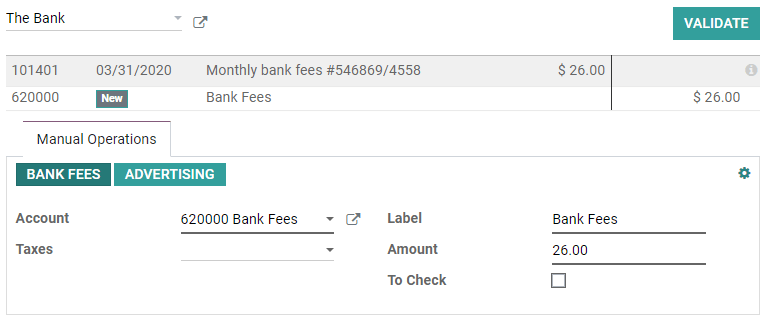

The video below will help you understand the process of bank reconciliation. Watch it to the end. It has some useful information, including what to do after your have identified the differences between your bank statement and your cashbook.

Benefits of bank reconciliation

Performing a bank reconciliation is important for a variety of reasons. For one thing, it ensures that your cash records are correct. If you don’t do this, you may be unable to detect fraud or cash manipulation. Bank reconciliation also provides you with information that you can use to make better controls on the cash receipts and payments of your business. It also keeps you from missing a payment or a double payment.

In the past, bank reconciliation used to be a time-consuming process requiring pen and paper and a checkbook ledger. But now, the process has been made much easier and faster thanks to technological advances. As long as you use a good method for tracking transactions, bank reconciliation is a valuable tool in financial record keeping and accounting. It is also worth mentioning that using a software program to automate this process can be very beneficial. It will speed up the process.

In order to learn more about bank statement reconciliation, you can download a free Excel template and use it to complete your own. These templates come with extra rows for adjustment. You can change the numbers to reflect your organization’s statements. You can also add or remove rows if necessary. The formulas that are included in these templates are the basic foundation of bank reconciliation. But it’s still essential that you know how to do it correctly.